Overview

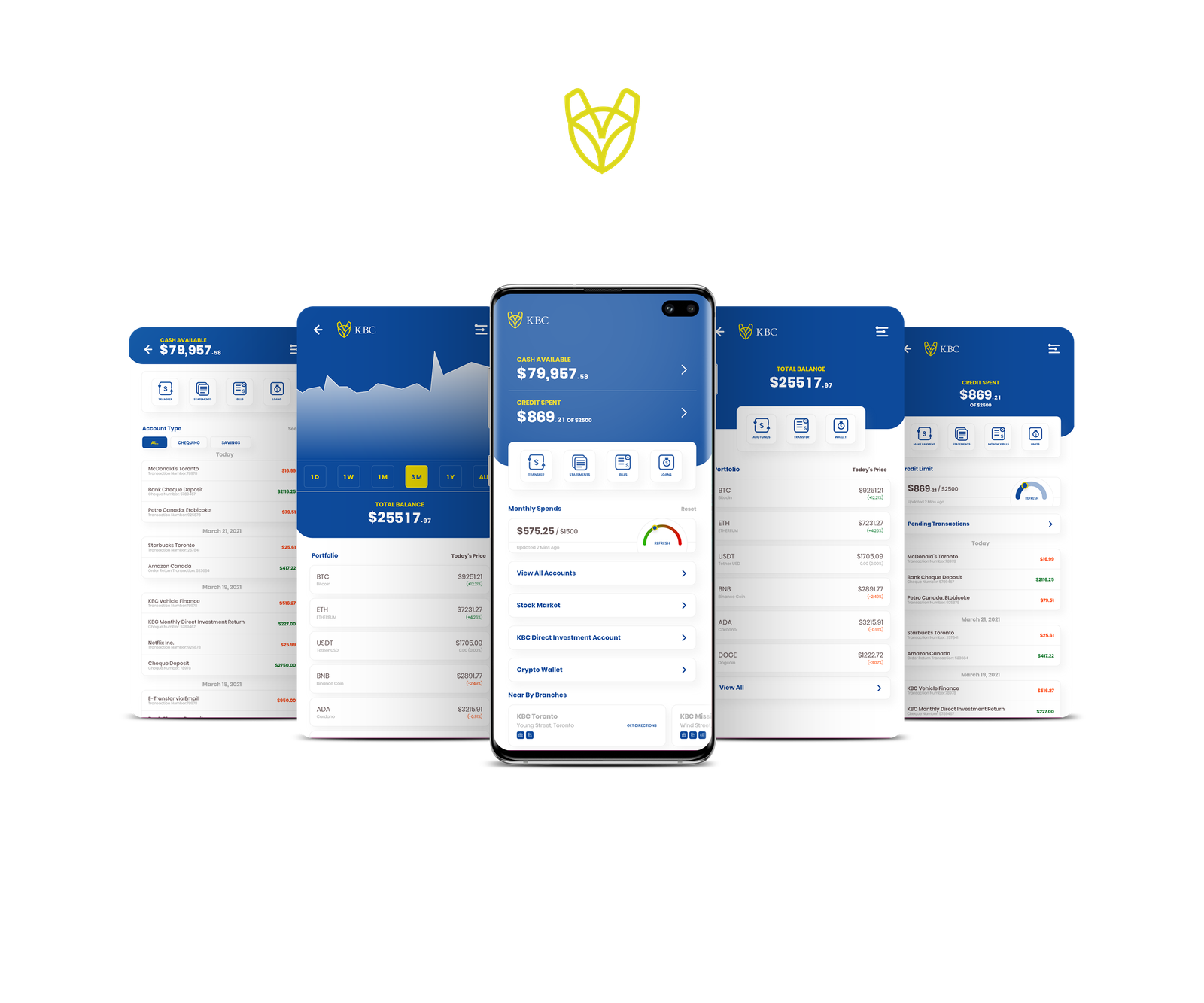

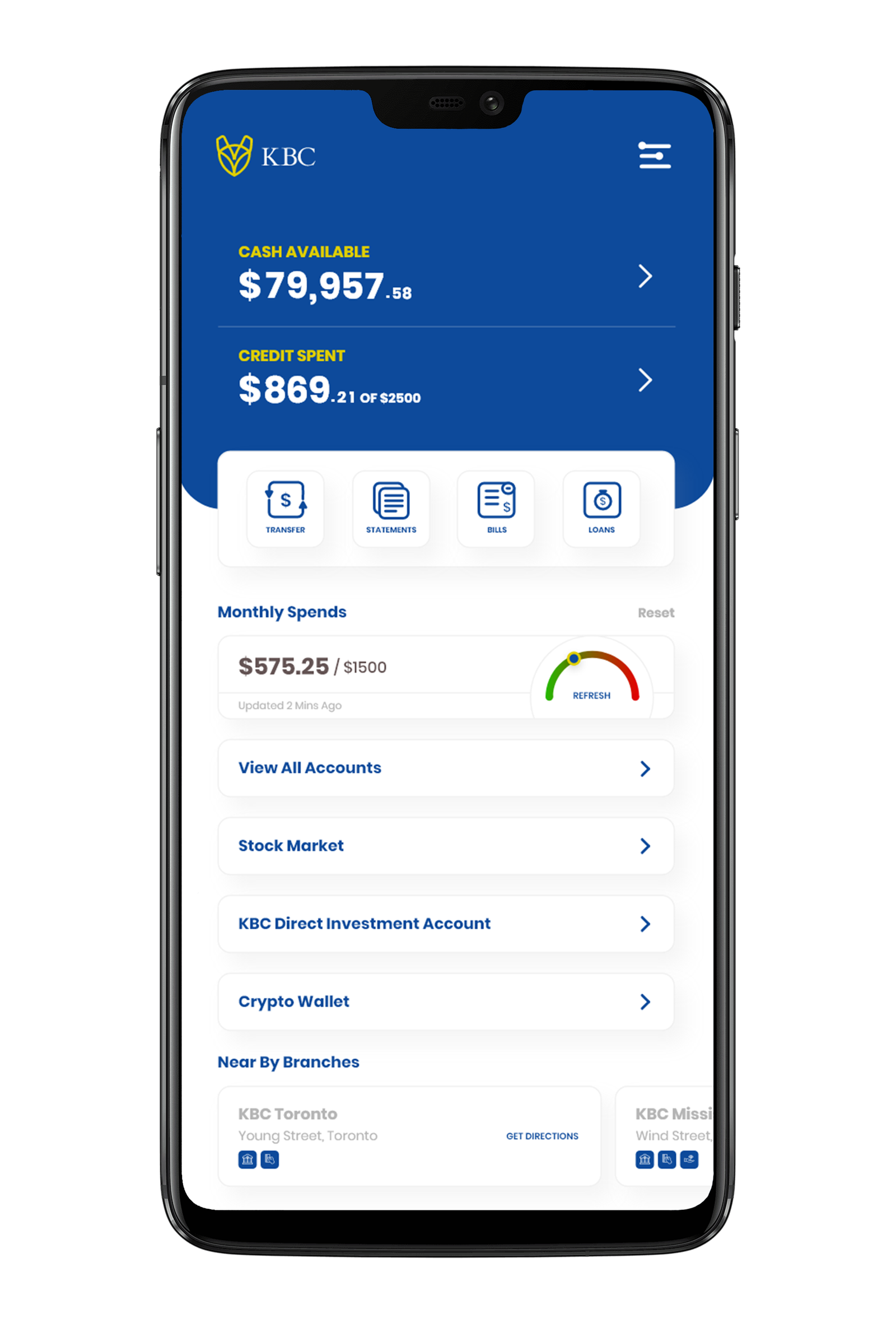

KBC is a Banking Mobile App idea to centralize the different banking modules. It is designed to deals with different market challenges such as Stock Market and Crypto Wallets. KBC is a combination of Traditional and Modern banking modules. KBC might be the solution in the future for a user-centric approach to get rid of different apps from the mobile and add different financial aspects into one single app.Challenge

The challenge here was to understand the existing banking structure and its workflow and merge crypto and stock trading into the same app.

Design-wise followings are the challenge that I tried to solve with KBC:

- An amalgamation of Traditional/ Existing Baking with Crypto and Stock Trading

- Easy user flow for three different modules in a single app

- Easy module availability every time the user logs in to the app

- User-Friendly/Detailed information for new modules (Crypto and Trade Marketing)

Role

Role: UX/UI Designer

Timeline: 3 Months

Platform: Mobile Application

Approach

- Defining different Modules and Limitations

- Understanding different structures

- Market Analysis

- Feasibility Testing

- Why market needs KBC?

- Low Fidelity Mockup

Process

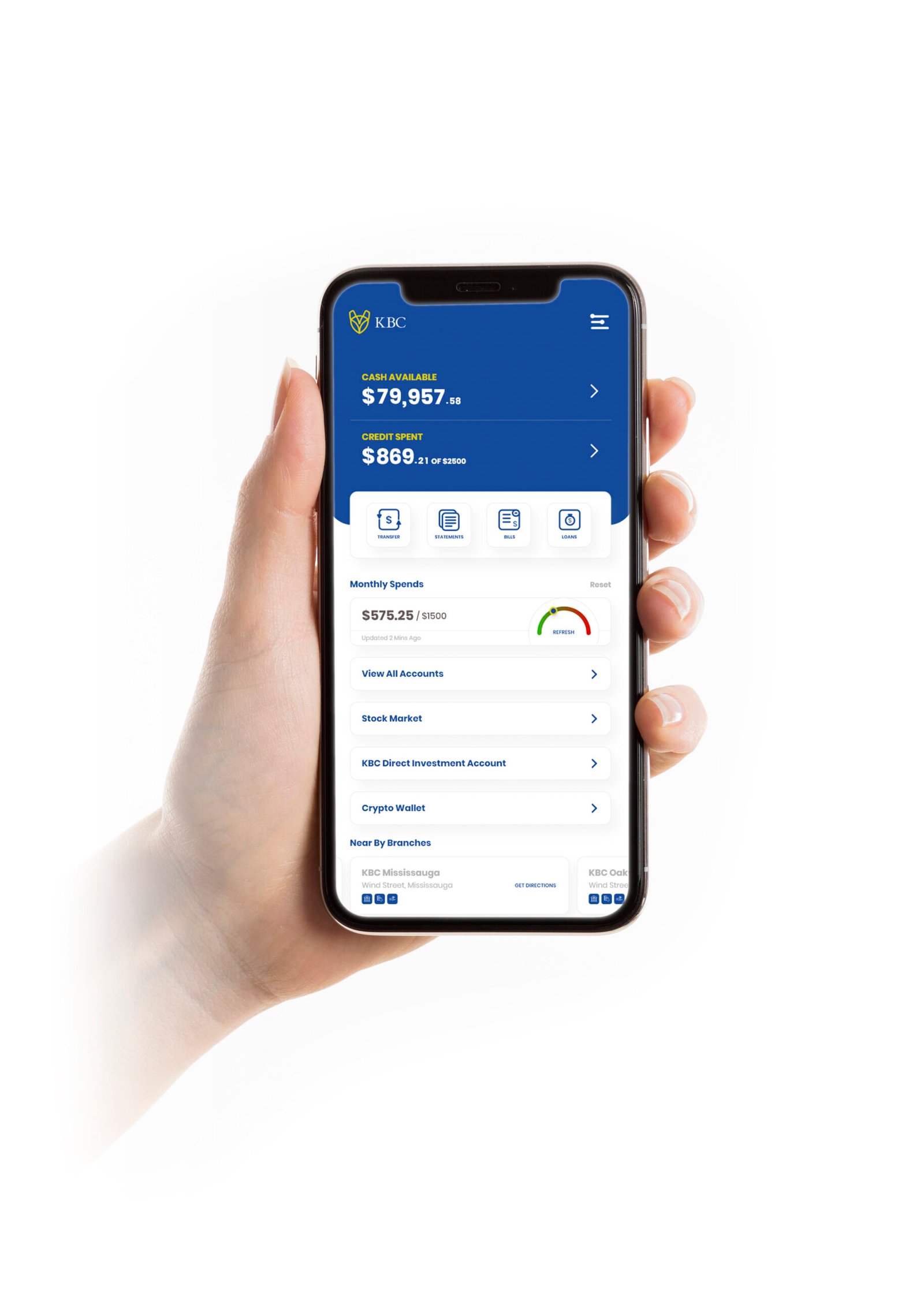

The process was to understand each sub-module and design a user-friendly interface. Once different modules are designed then link them to the central banking interface.

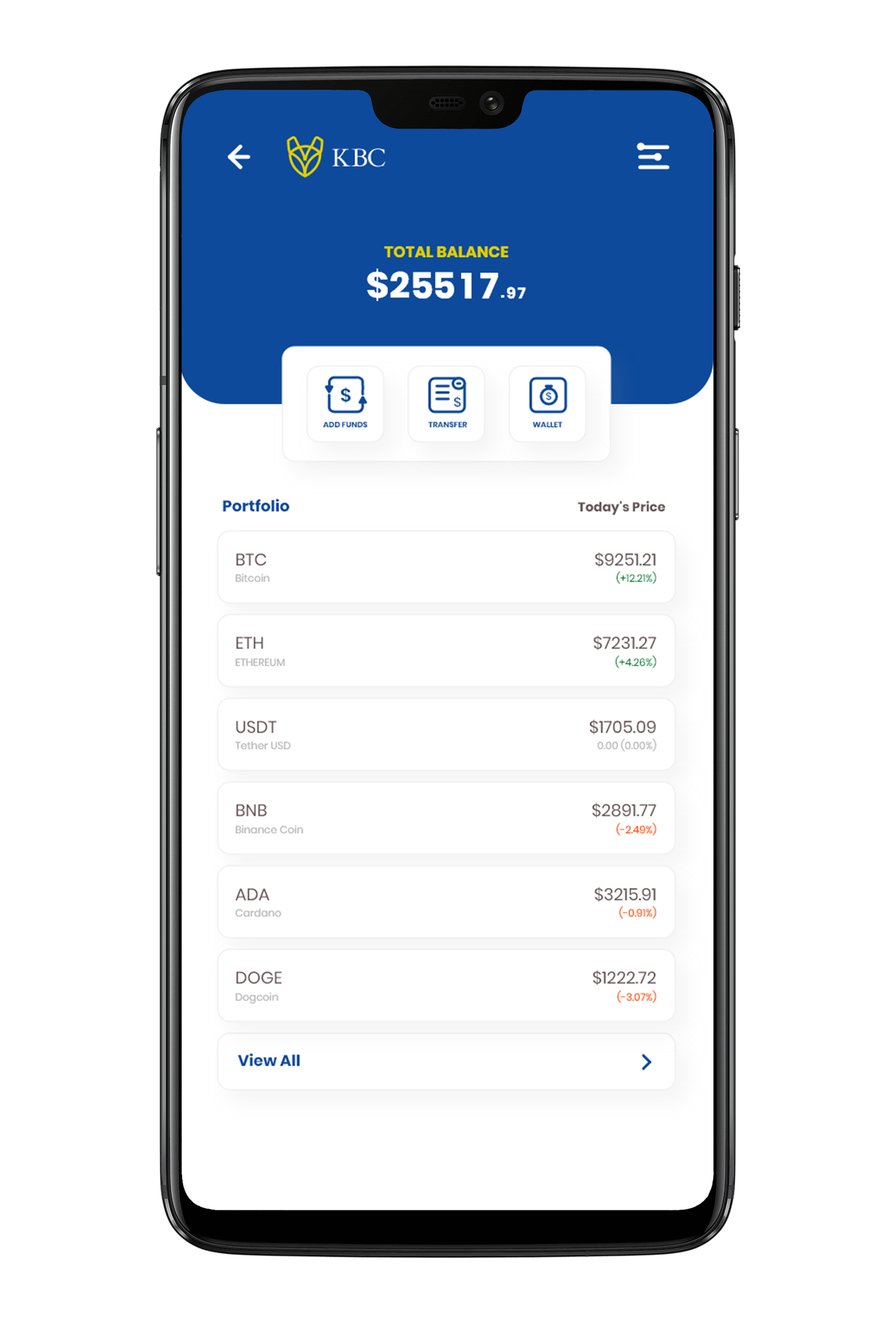

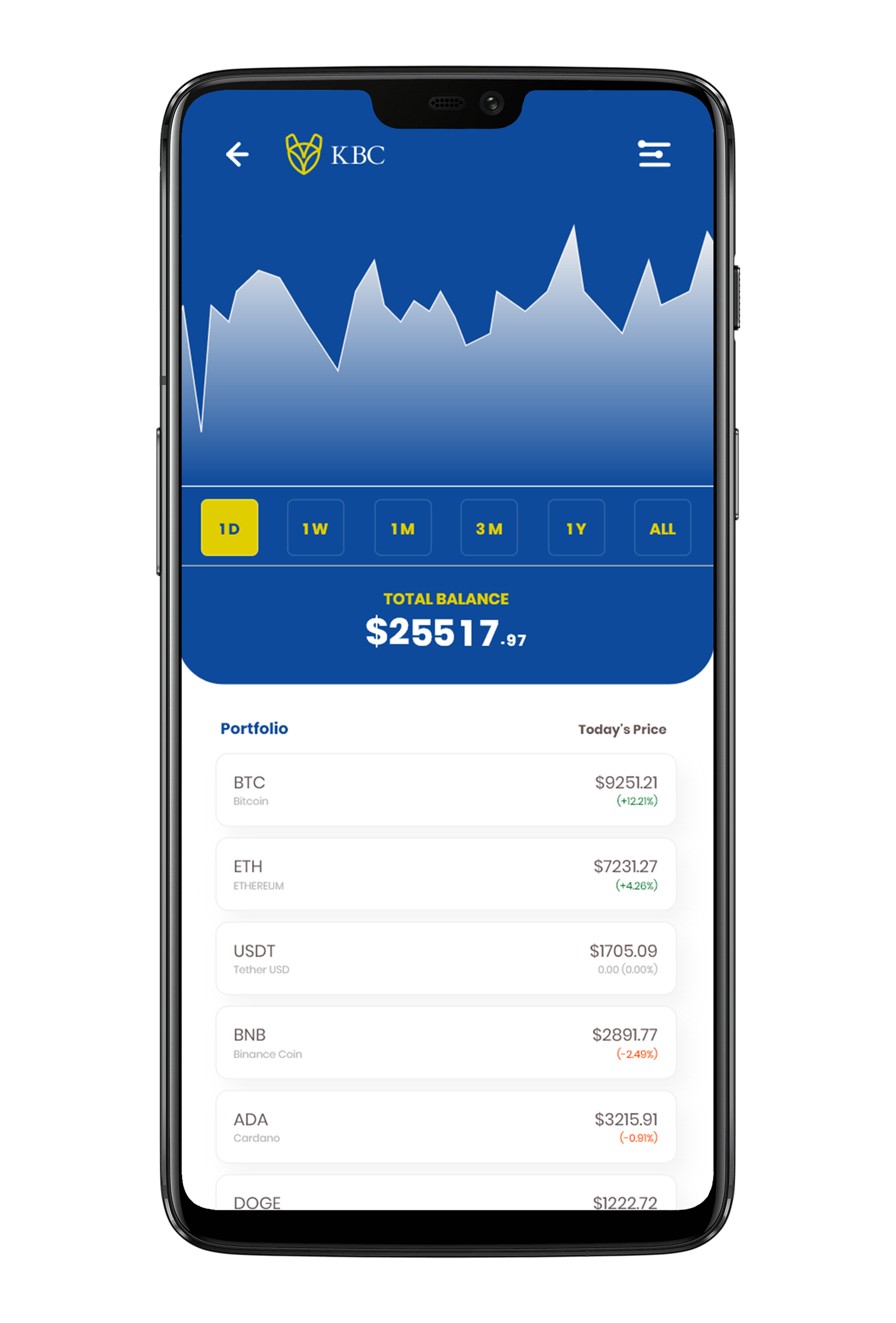

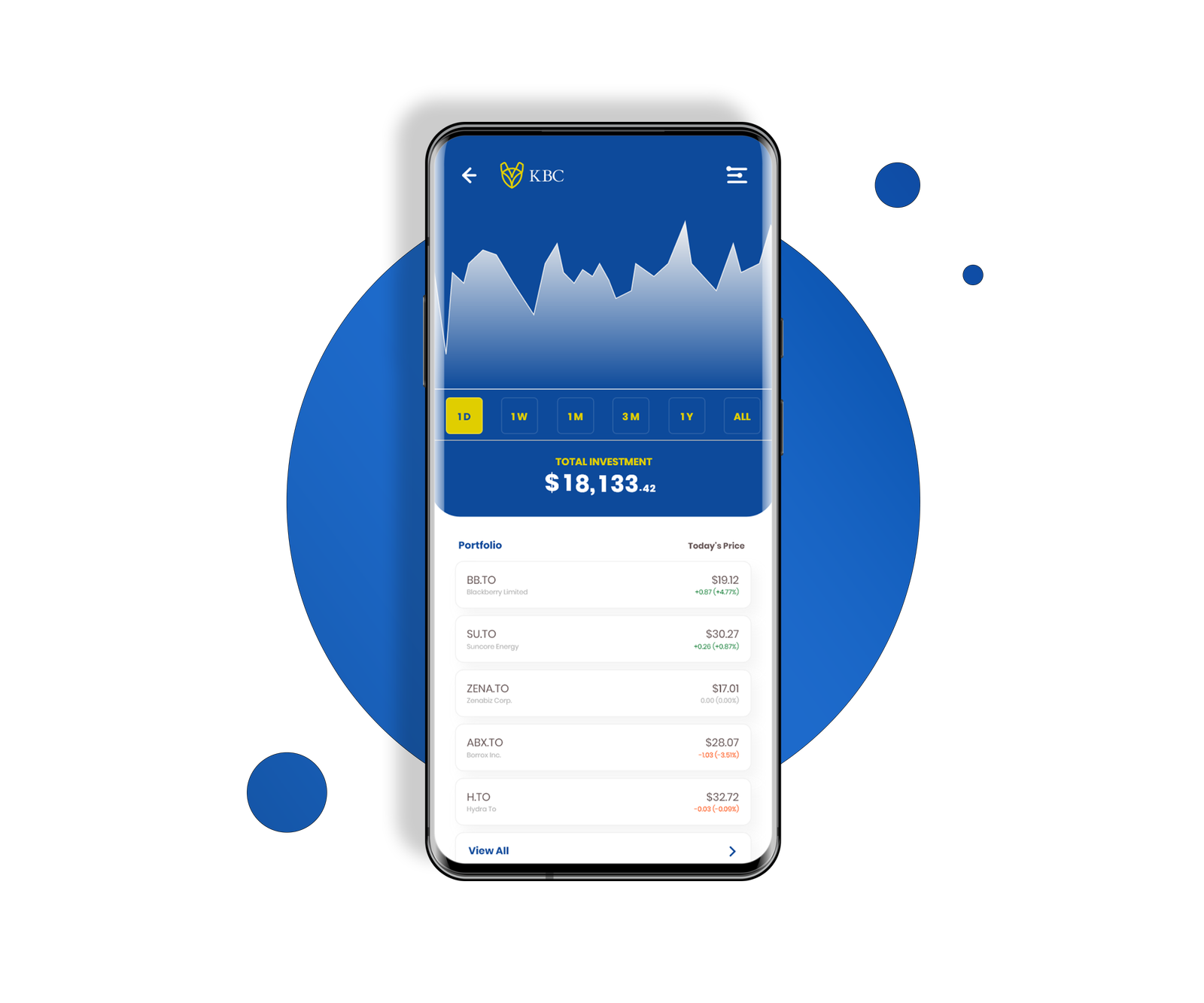

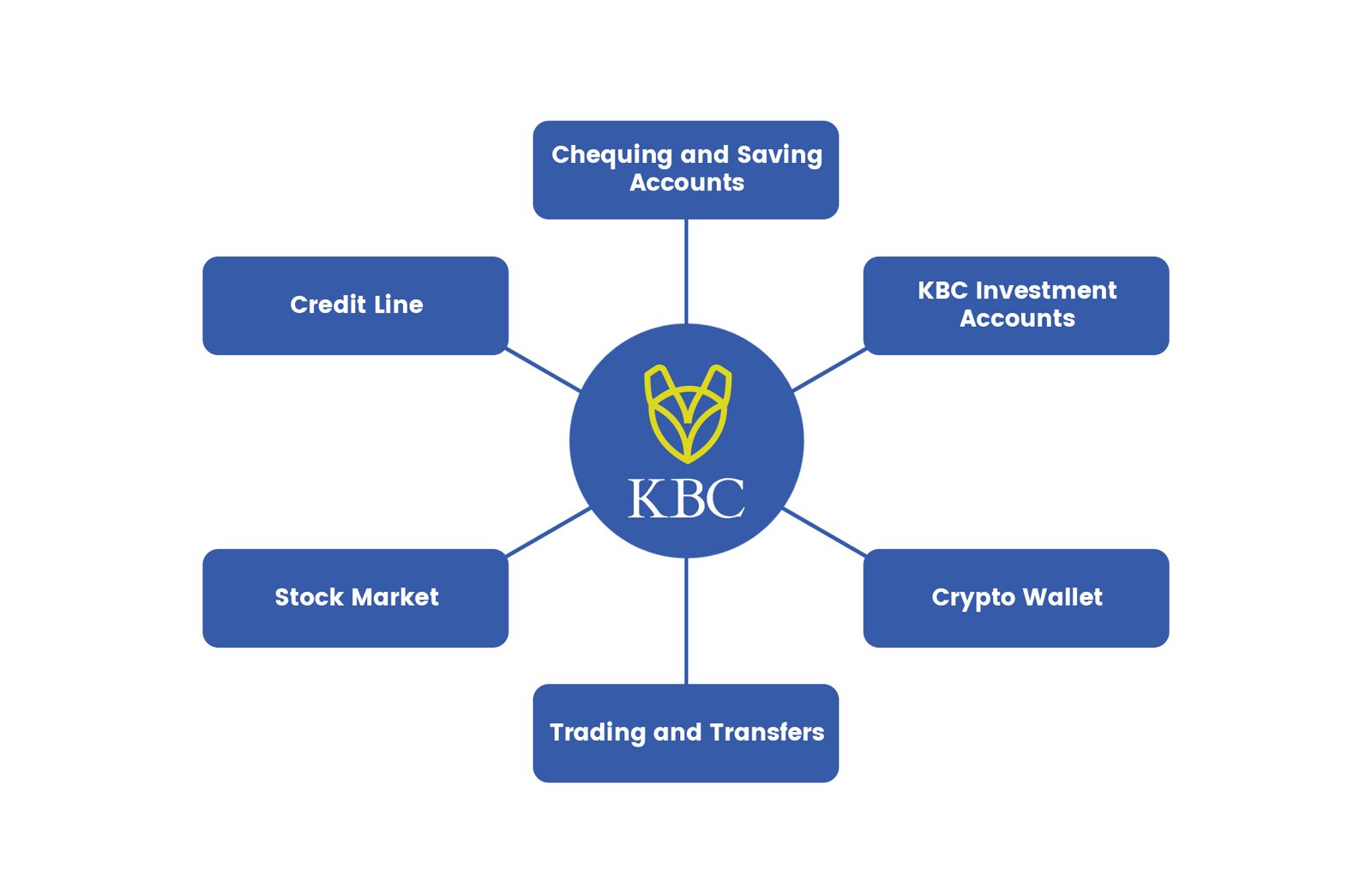

Right now, KBC is divided into the following different sub-modules:

- Chequing and Savings Accounts (Traditional Banking)

- KBC Investments (TFSA, GIC, and RRSP Accounts)

- Credit Lines (Credit Card or others)

- Stock Trading (Buy and Sell)

- Cryptocurrency (Buy and Sell)

- Trading and Transfers (Within KBC)

Results

- Single Centralized Application

- User-Friendly Flow/Design

- Easy to Navigate (Even for beginners)

- Secure

- Trustworthy (For Trading)

Research

The users are very active in earning Passive income these days. Stock Marketing and Crypto Trading is the best option for users as anyone can start investing in these even with $50. The process became very hectic regarding the actual trading as the user needed to use several different apps. For example, one is for transferring money from Bank Account to Crypto Account. Transferring the amount to Crypto Trading Account and then saving the cryptocurrency to a crypto wallet. Now, it is not just the process, these apps have hidden charges and always ask for user data which is not even necessary.

Market Analysis

- There is no such combination of KBC in the market.

- However, the user needs to use different apps to get the result

- For example, Traditional Banking app for Regular Banking Transaction

- Different Stock Trading Apps to Deal with Stocks

- Different Crypto Trading Apps to Buy and Sell Crypto Currencies and Crypto Wallet apps to keep the cryptocurrencies secure.

Banking

Stocks & Crypto

Feasibility Testing

Even though there are several legal restrictions in the process but the development of the centralized system is feasible in near future. We know traditional banks are dealing with different types of Currencies for a long ago under Foreign Exchange Services and also they have a department that works in different investments such as Gold or Platinum. Stocks are not new to the Banks as it is the biggest source of income for them. So we can conclude that Concept like KBC is feasible within the coming years.

Why KBC is the future of Banking?

Trust

Trust will be the biggest factor for KBC to lead the market. As most of the Stock and Crypto trading apps are privately owned so there is always a lack of trust among the users. The users experienced limitations while making purchases and selling their stocks. The same issue had gone to the different courts in the US and Canada where App System stopped users to make any transactions to free up their own stock holdings. The same was experienced in Crypto Market where Government agencies found App developers doing Money Laundering. In some cases, users lose all their crypto earnings and, in most cases, cryptocurrencies are near to impossible to track.Centralization

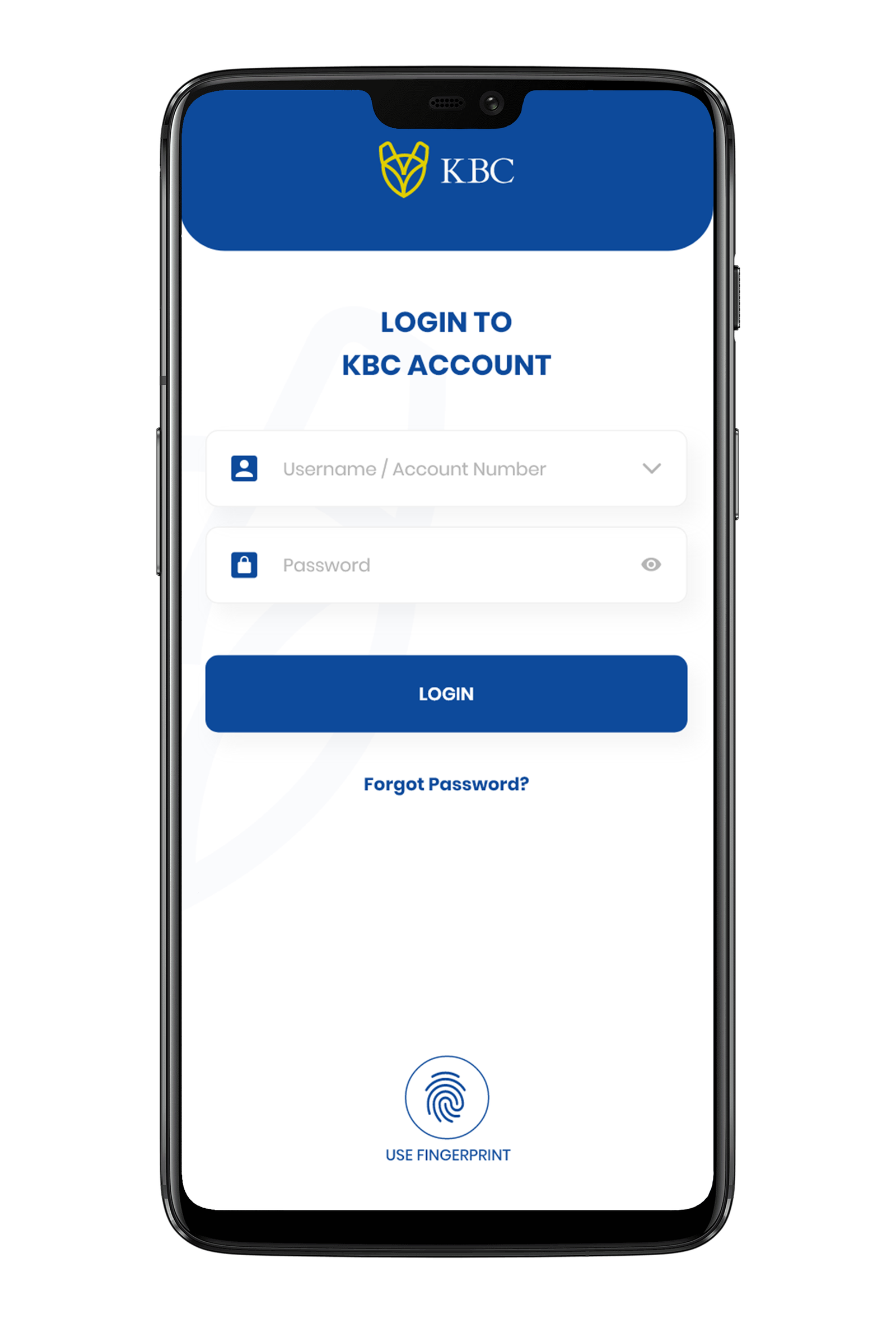

KBC will provide a single platform for different markets. The users can handle their Traditional Banking Transaction and Digital Transactions (Crypto) from the same app. Having a single platform will increase the security and the speed of transfer at the same time.Security

Traditional Banking customers are relying on the system for hundreds of years. Banks have the infrastructure to secure the user’s data and money from online and offline frauds.Customer Service

Banks are known for their best customer service. Also, Banks have the large human power to handle different departments.